If a successful investor (Who has grown his portfolio 15% every year for the past 8 years), were to offer you to buy his entire Portfolio of shares and cash. with a 20% discount Would you consider?

If this person tells you, his portfolio has 50% cash, would you consider?

Lets say this portfolio is RM400K in size. With a 20% discount, you are paying RM320K for the cash and shares

What are you really buying with RM320K?

You will get RM200K cash and RM200k worth of stocks

In other words, only RM120K is coming out of your pockets since you are getting back RM200K in cash (RM320k -RM200k).

Which also means, you are only paying RM120K for a collection of shares worth RM200K. That is a RM40% discount.

Well, you would say: "it depends....what are those shares?"

He shows you, he owns the followings:

Meaning you are buying Padini holdings, Bousted, Suria Capital, PIE industrial, F&N for 40% discount from market price...

Unbelievable as it seems, but it is true that such a deal exist!

Icapital.biz Berhad is such a company now.

What do Icapital.biz do?

In a nut shell, it is a closed end fund and the fund manager is Mr.Tan Teng Boo. Its investing philosophy is by Value Investing. The company invests in shares of public listed company and makes profits either by selling it back or by receiving dividend from them.

The general difference between a open ended fund (aka-unit trust) is, its unit size is fixed. Unlike unit trust, you don't subscribe to this fund from a agent. the only way you may own it, is by buying from someone else from the stock market just like buying Public Bank shares or Genting Berhad.

The other benefit of a closed end fund is, the fund manager can really do what he do best, buying a sound company at a good price and selling them only when he thinks it is over valued. He is not tied up with changing fund size.

unlike a unit trust fund manager, who has to sell at market price when many people redeems, in order to repay them. He has to buy at market price when people invest in his fund as he is mandated to only keep about 20-30% cash.

Historical, most people would invest in unit trust when the share market is on a Bull run, when prices are high, when do they sell? Yup, during a market crash...forcing the fund manager to sell at a low price...

Buy High sell Low is not going to make you money! It is not a secrete 80% of unit trust do not very well.

There are many other benefits of a close end fund vs open ended fund which are discussed in many other websites. We wont be discussing it here. Please Google for more information. one place to start is here :

CEF vs UTF

Current state of things at Icapital.biz

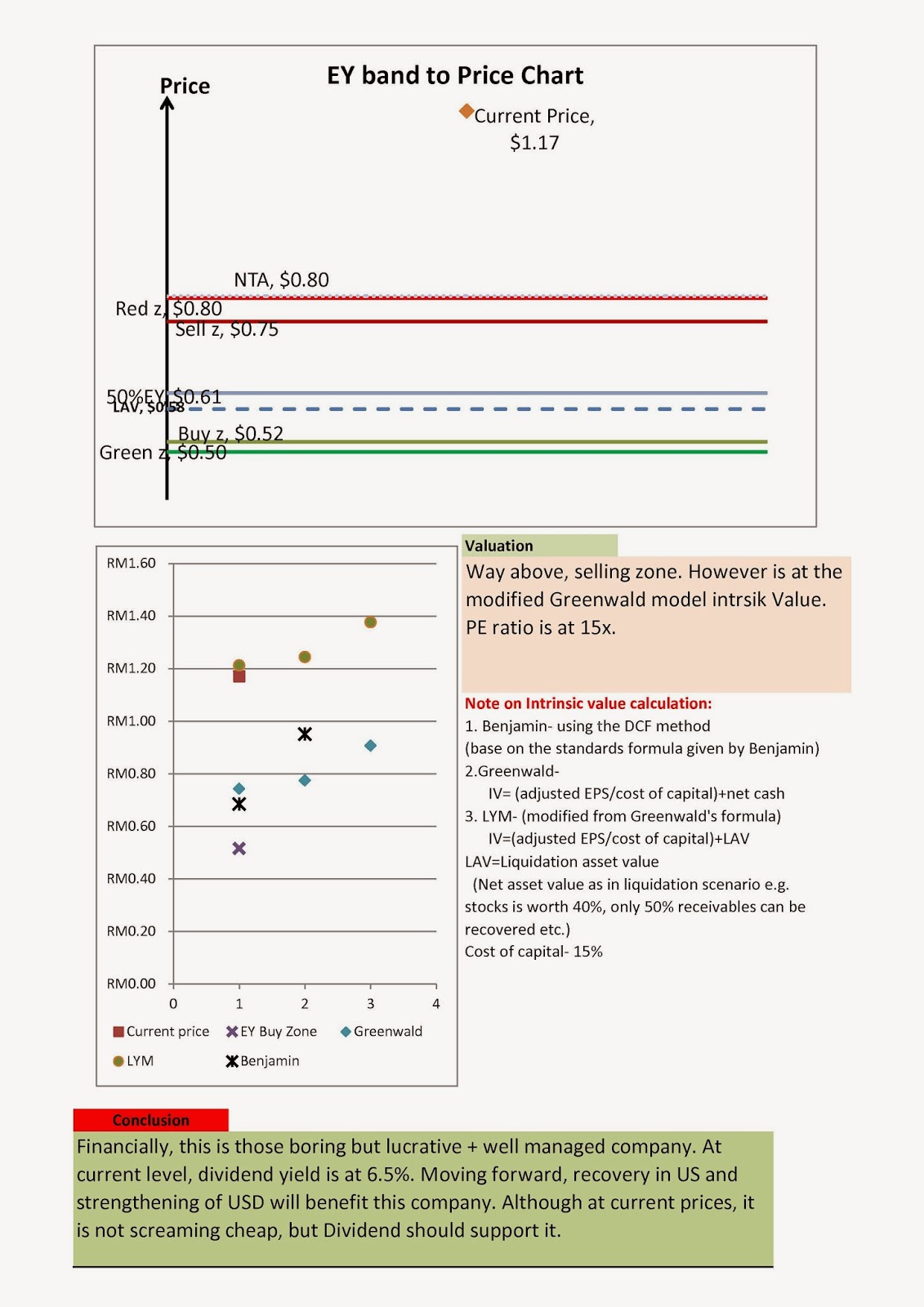

NAV- net asset value per share of Icap is arround RM3.09 yet its market price is RM2.45 (as of 28/8/2014) which is about 20.7% discount. The company announces its NAV every Thursday after 5pm.

Below is taken from its latest quarterly report:

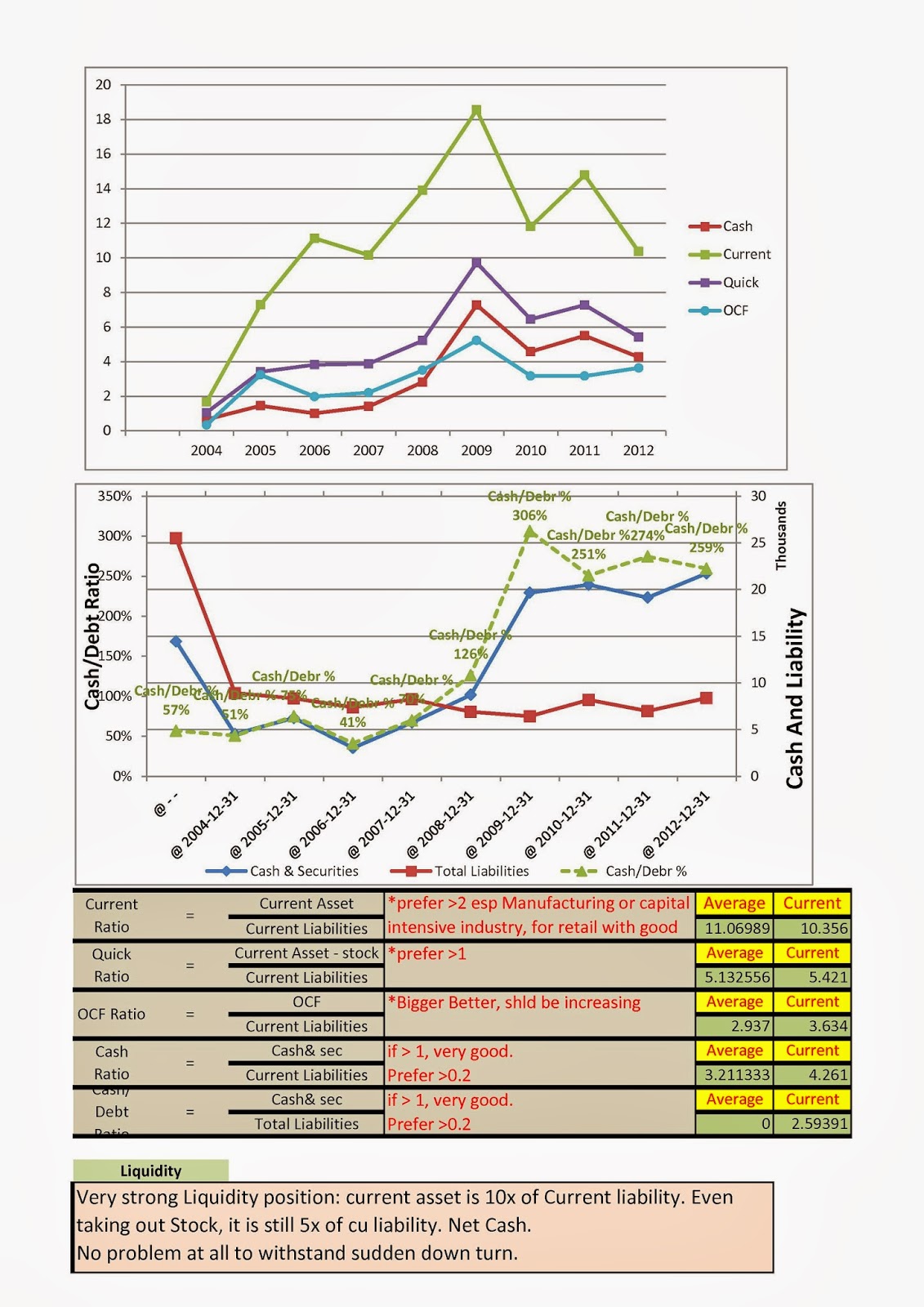

The entire portfolio is worth RM428million and has about RM185 million in investments (shares), and RM240million in short term deposits and bank. Which means it has 56% in cash and 44% in Shares. The various company it has invested in, is as shown in diagram 1, Which really means your buying Padini for more then 40% discount if you buy the entire portfolio.

However, we are not buying the entire portfolio, so we wont have access to the cash. What is the benefit then?

Why invest now?

1. One of the key element in Value investing is to look for sound companies and buy them cheap. At current prices, it is undervalued. At one point in 2008, you have to pay a premium to own it! Now you are buying with a discount.

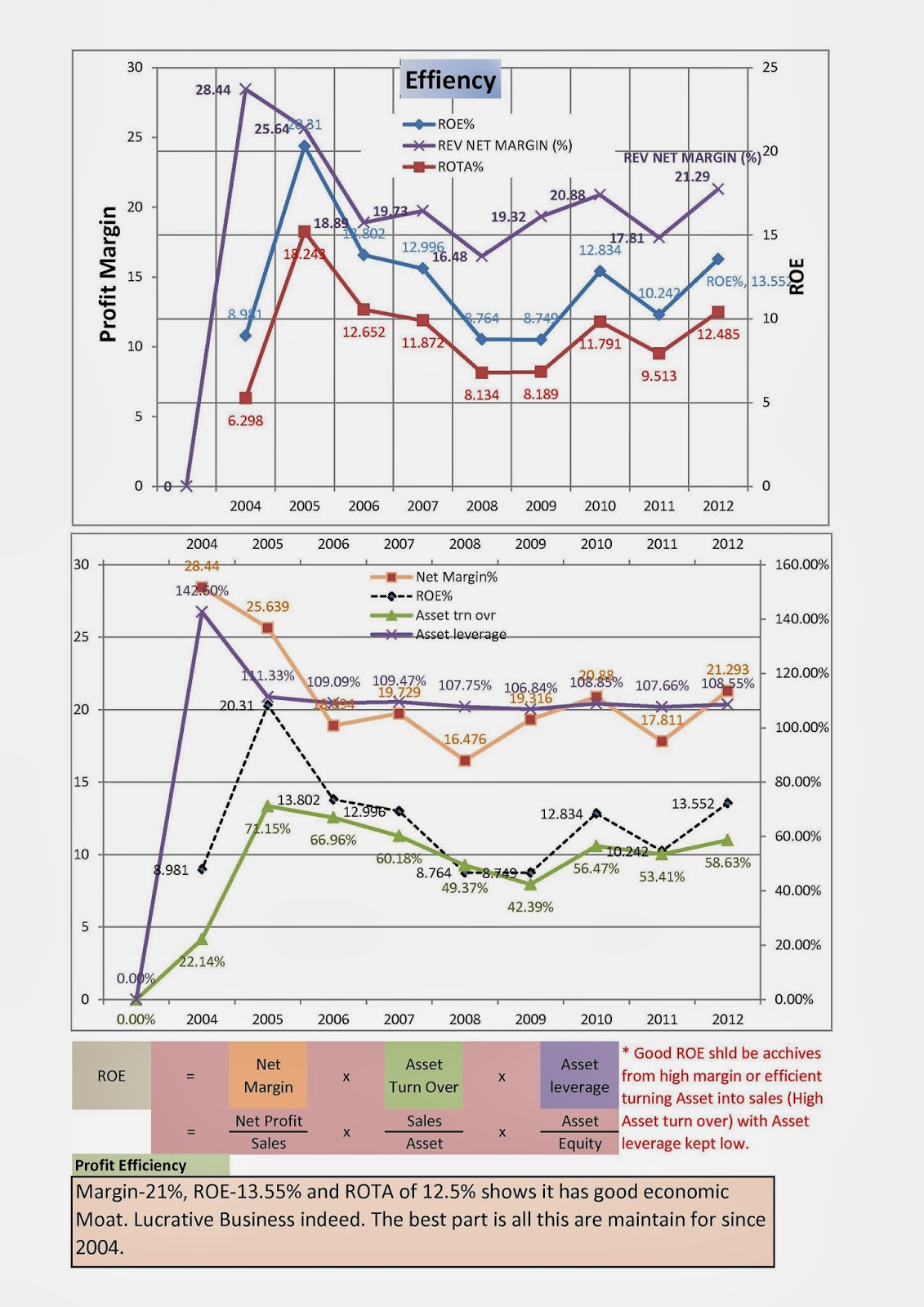

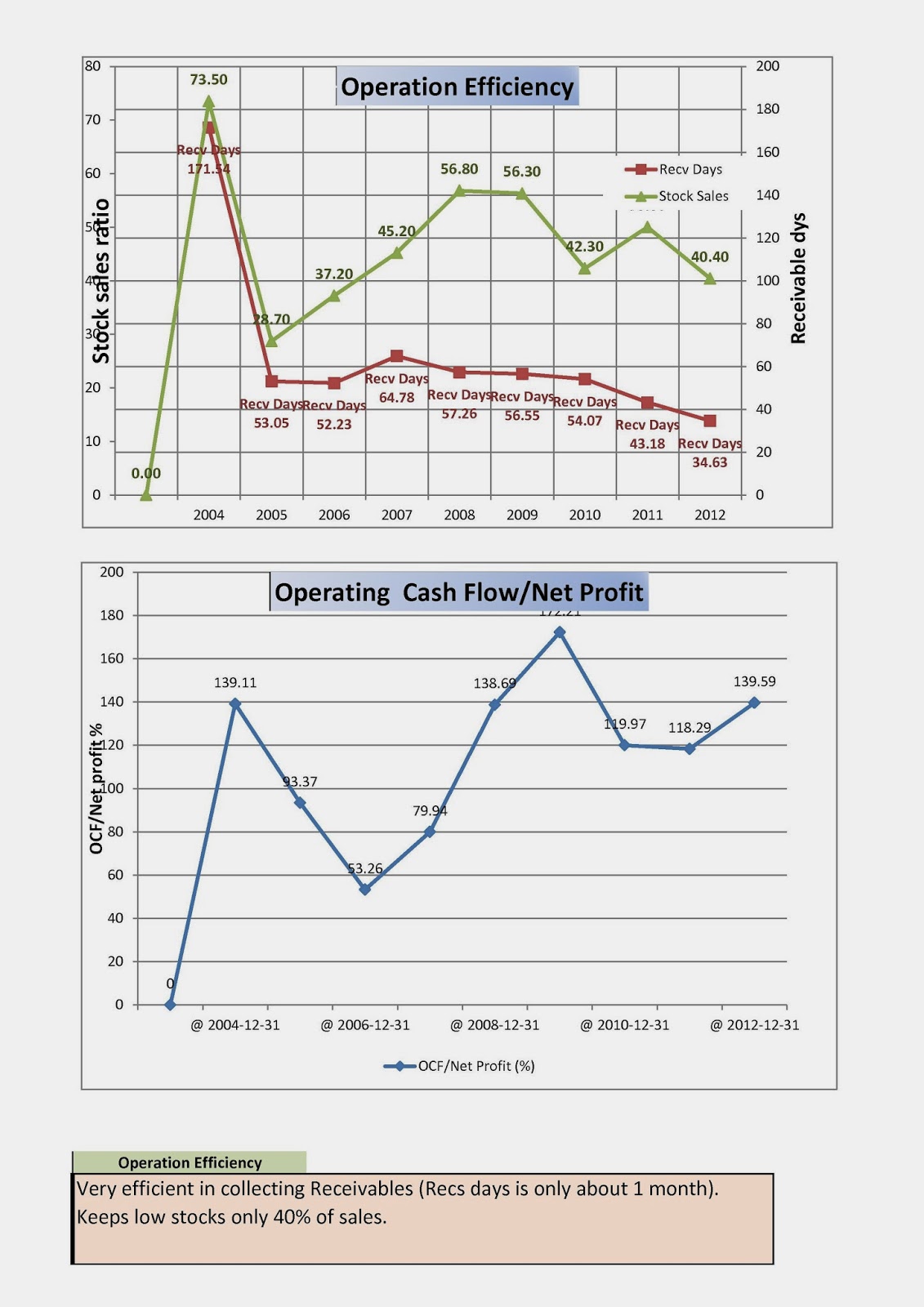

2.It is run by experience manager. Mr.Tan Teng Boo is known fondly by his followers as "Warren Buffet of Malaysia". If you are not familiar with stock market but want to expose to it, yet you hate the charges by unit trust, this is the counter you want to have.

3.It is a known fact that, the company is trying to close the NAV-price discount gap. One way to achieve this, They announced in 2012, is by going for a dual listing. Meaning, this counter will be listed in another country as well.

Where will it be dual listed? They have not announced, but last year, during AGM, a share owner asked "how much are we spending for this exercise?", Mr.Tan said "a couple million of HongKong Dollar". and recently they also opened a Hong Kong office. I believe the targeted listing will be on Hang Seng. Interestingly in the latest Annual report he wrote this:

out of a blue he mention about EGM...the last EGM was in 2009 and that EGM was to vote if it could invest in overseas. Share holders was advise against it then, sighting the reason as it's fund size was too small then.

It's fund size has double since 2009. Will this be revisited? My take is, likely they will dual list in Hong Kong and use the cash it has now to invest in Hong Kong.

If this does materialize, I am sure it will attract a lot of attention. As a share owner this is a good thing especially if you believe in the China growth story. By then, hopefully, the discount will turn to premium.

The ugly part of Icapital.biz

1. For starters Mr.Tan Teng Boo is a "firery" figure. He would say what he thinks on your face irrespective if you will like it or not. He has been heavy criticizing the government for the country's policy. With this, you can forget about the government funds investing here...and Icapital.biz is about him making the shots. So you are expose to his good and ugly.

2.Will the discount gap be close? no one knows. If the market crashes, its holding will reduce in price so does its NAV. However, since it is holding more cash, Its NAV will reduce slower then the overall market. The discount gap might actually increase.

3.Holding too much cash is a double edge sword. If market crashes, your are safe. However, If the market goes for another round of Bull run..you wont be in to ride the wave.

4.This is a fund... so you can be pretty sure none of the brokerage houses are covering it. So no one to make a "call" rating...exposure is low, short term no excitement.

Note: I am a share Owner of Icapital.Biz

Happy Investing !