The above is the front cover page of Classic Scenic's 2012 annual report. Not the most beautiful one but a interesting one. Why? If I am not mistaken it is the only one which quoted from the Bible. In fact in last years AGM, I manage to catch hold of one of the director and ask him about it. True enough not only the Chairman is a christian but the whole board are from 2 churches in KL.

Don't get me wrong, I am not saying christian run companies must be a good company (if this was the case, then almost all companies in US and UK are great companies, Enron included..... I will be the 1st person to rubbish it). However, to put it up on the front page shows that this guys do take religious belief seriously. My humble experience tells me, someone who is religiously incline, really takes it seriously and practices it to the true meaning of the teachings are some what reliable. Certainly this is not always the case, not 100% full proof but something to keep in mind.

Having said that, what is more important here, is the company profitable, does the management take cares of us, the minority share holders, can the company grow and is the price right to buy.

What does the company do? It manufactures high standard photo frames. Run by few brothers and was founded by their father. From making carbonated drink wooden crate, finally ventured into photo frames when the crate business disappeared. It was the current Chairman, the elders son, who went to Taiwan to learn the trade. (The story from he unwillingly took over from the father due to cancer and finding a willing Taiwanese to teach him is a encouraging one and was featured in one of the Taiwan talk show program). From the factories in Rawang, strips of photo frame is produced and sold to mostly US and Europe.

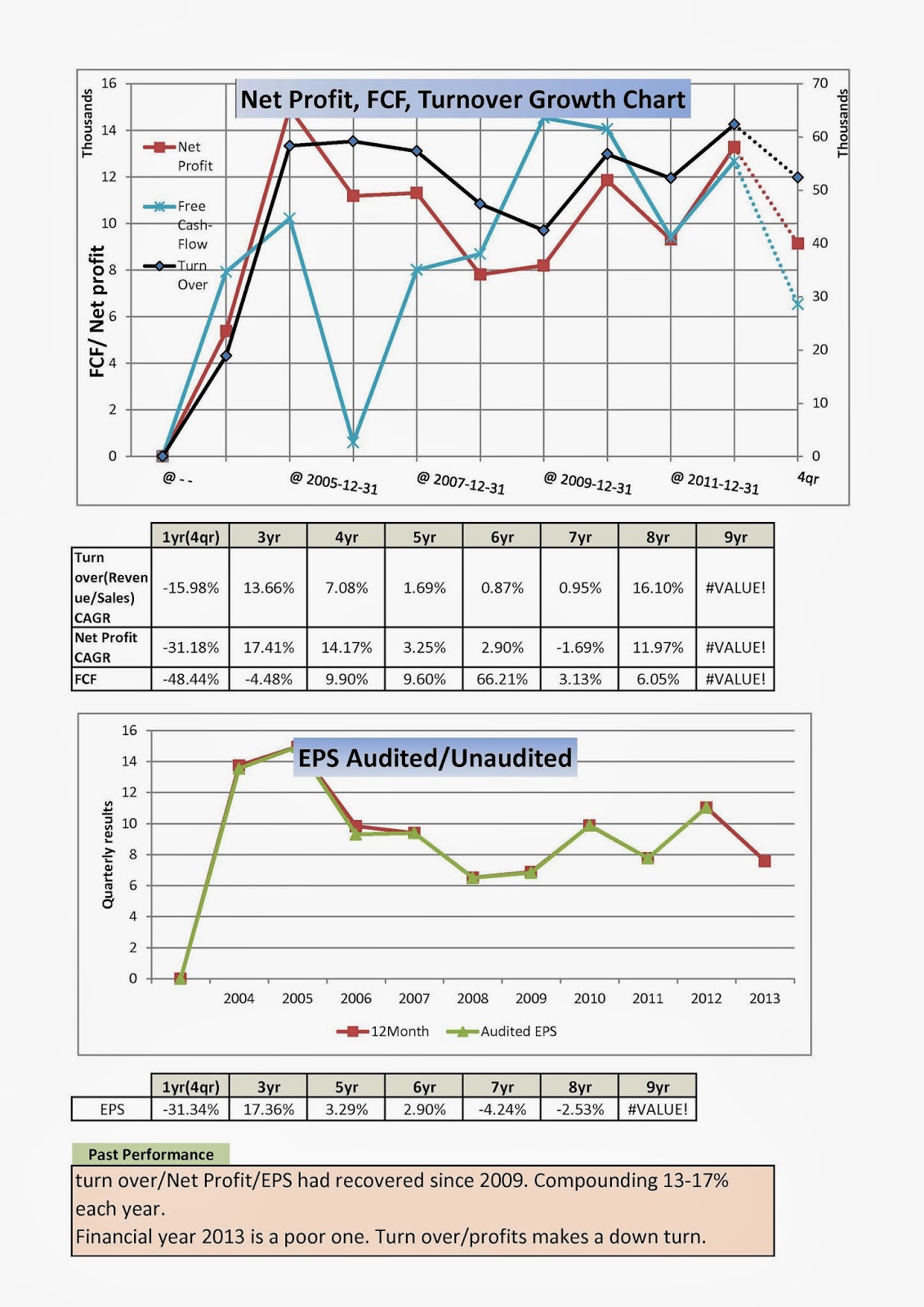

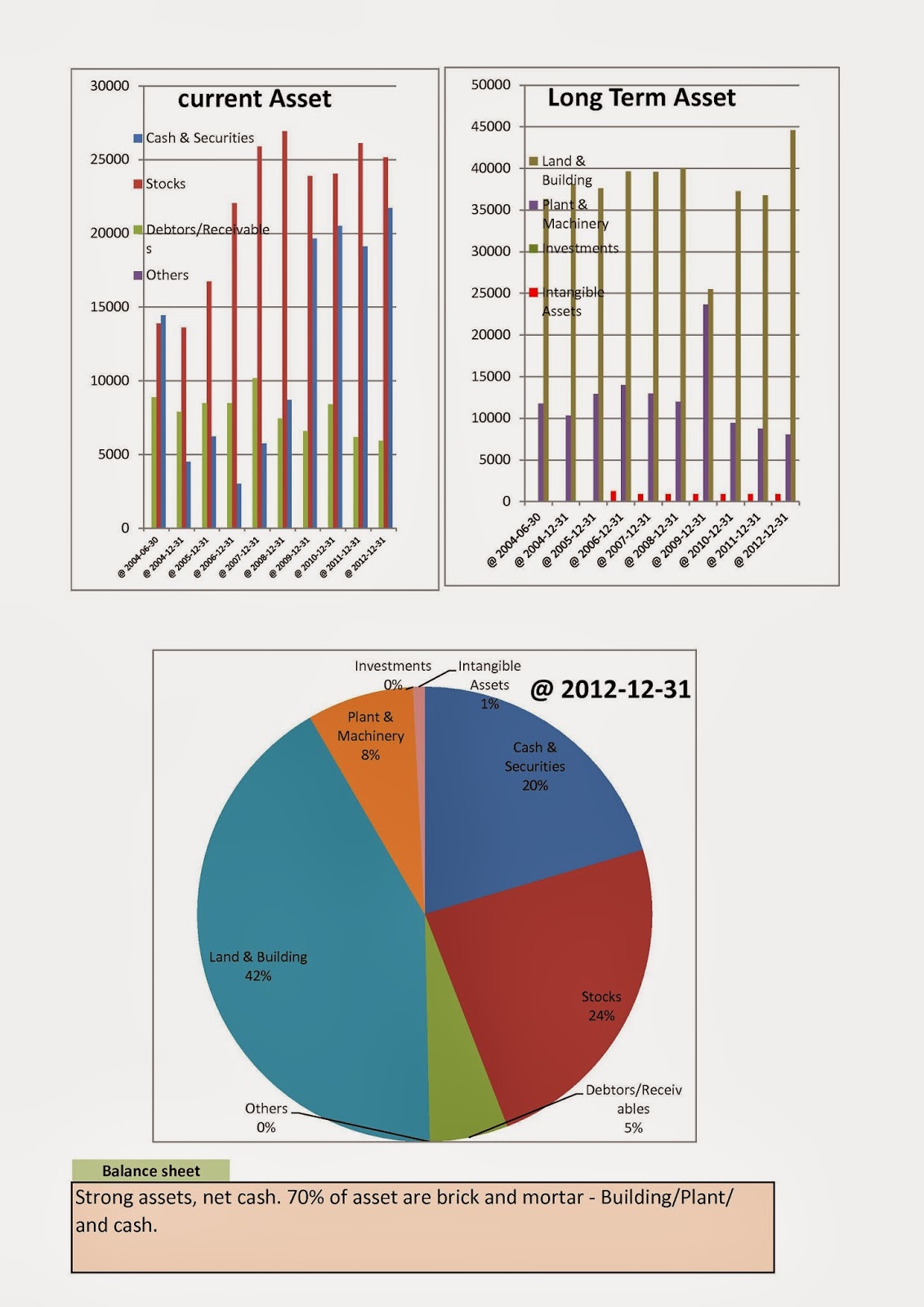

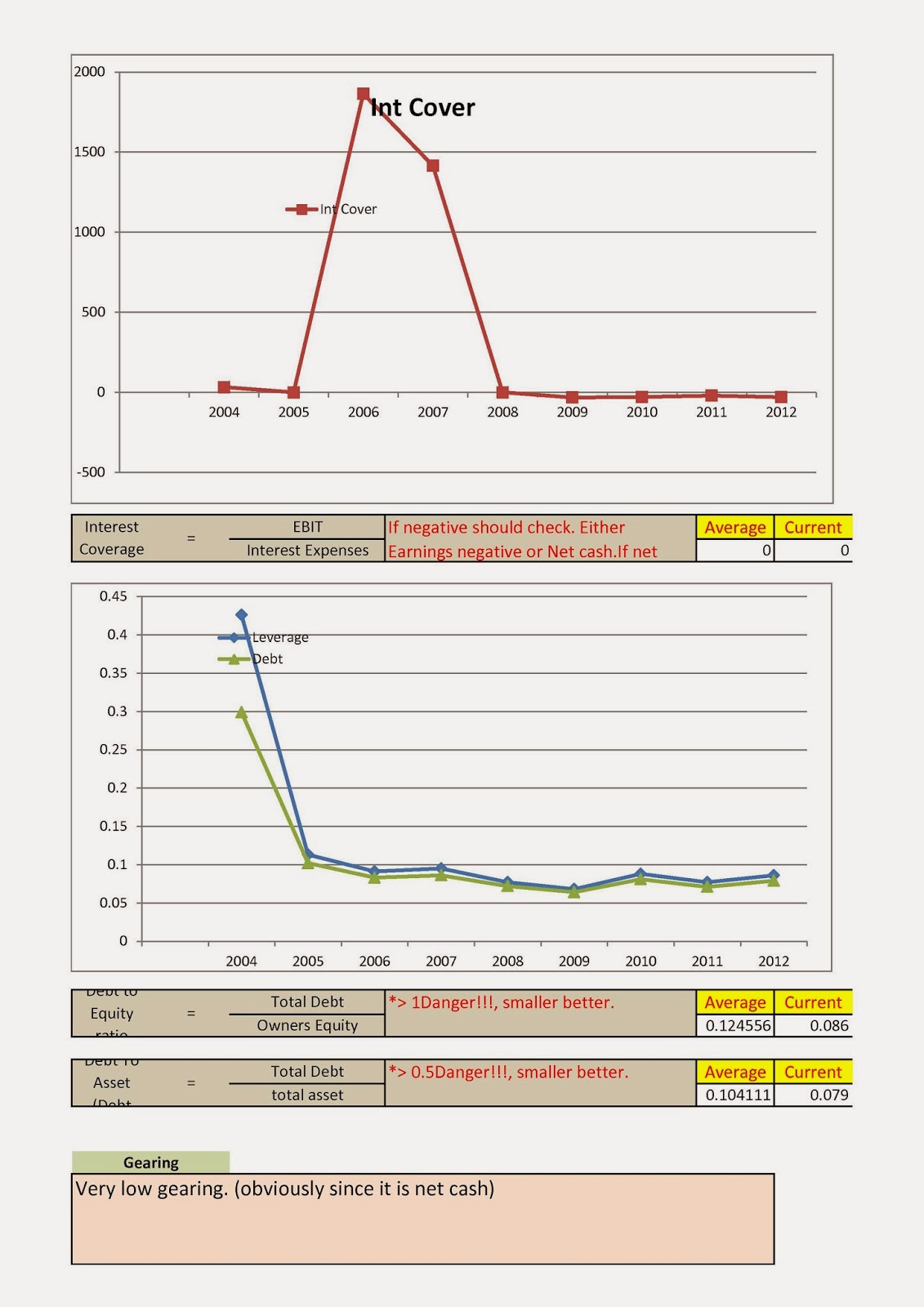

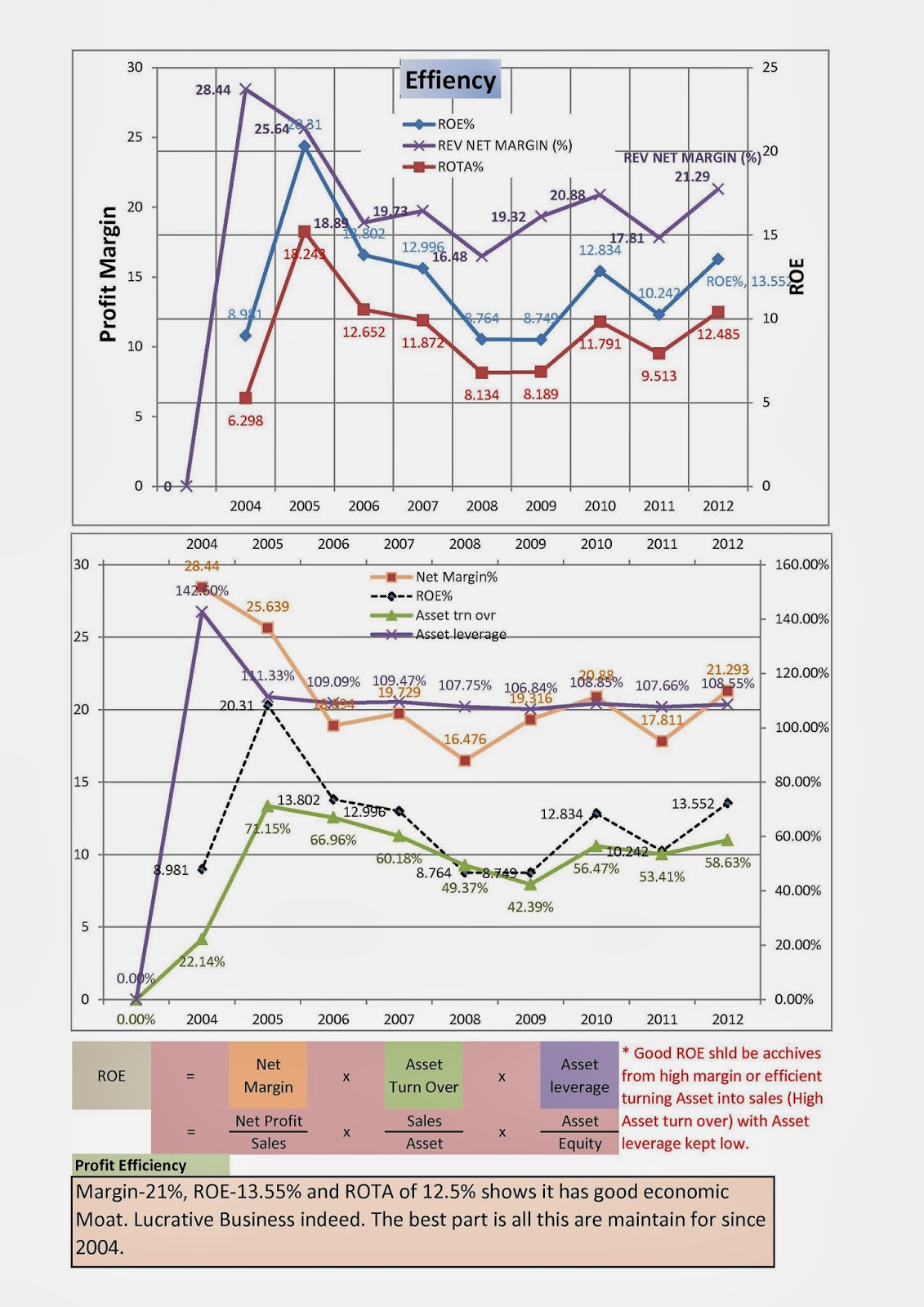

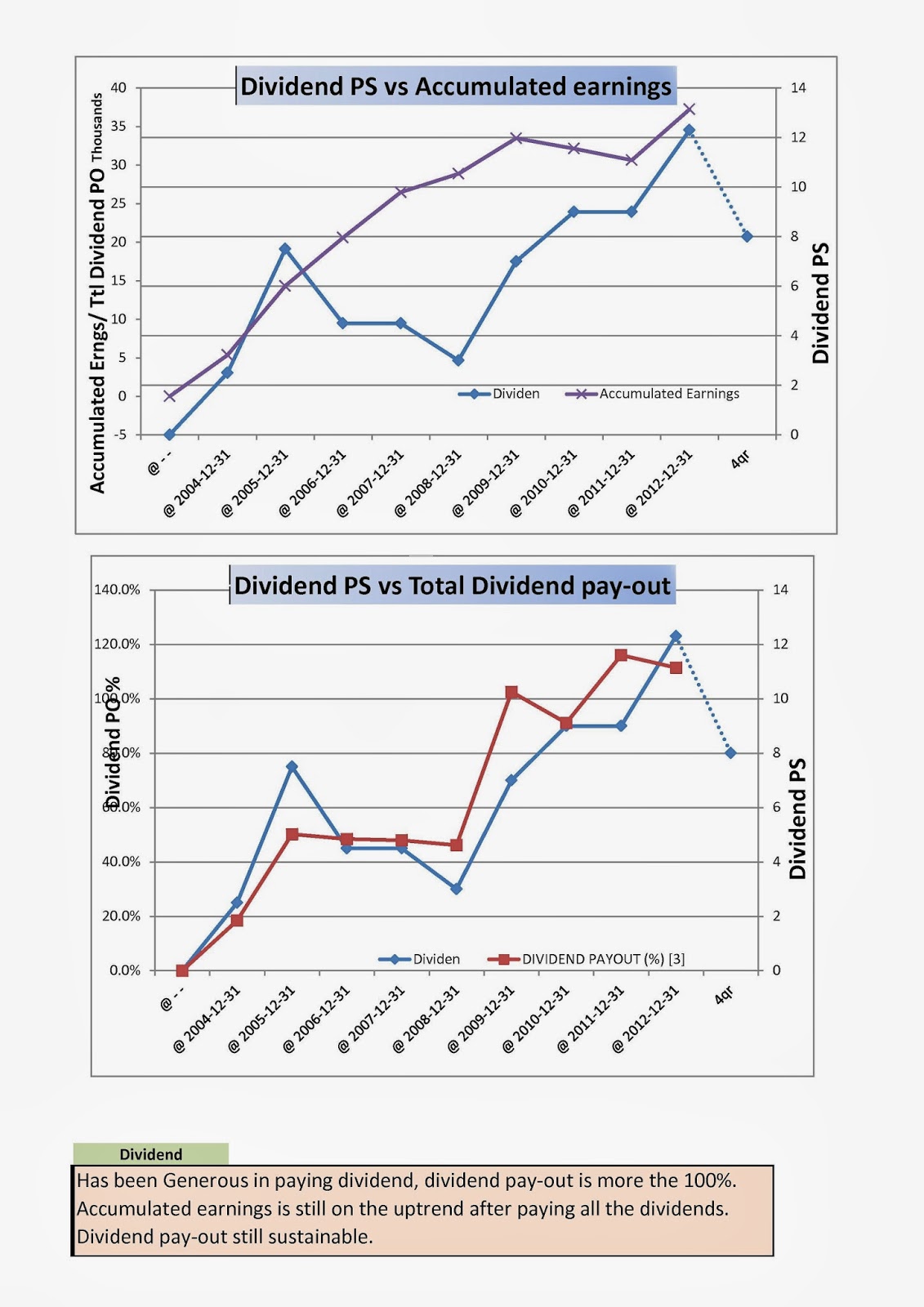

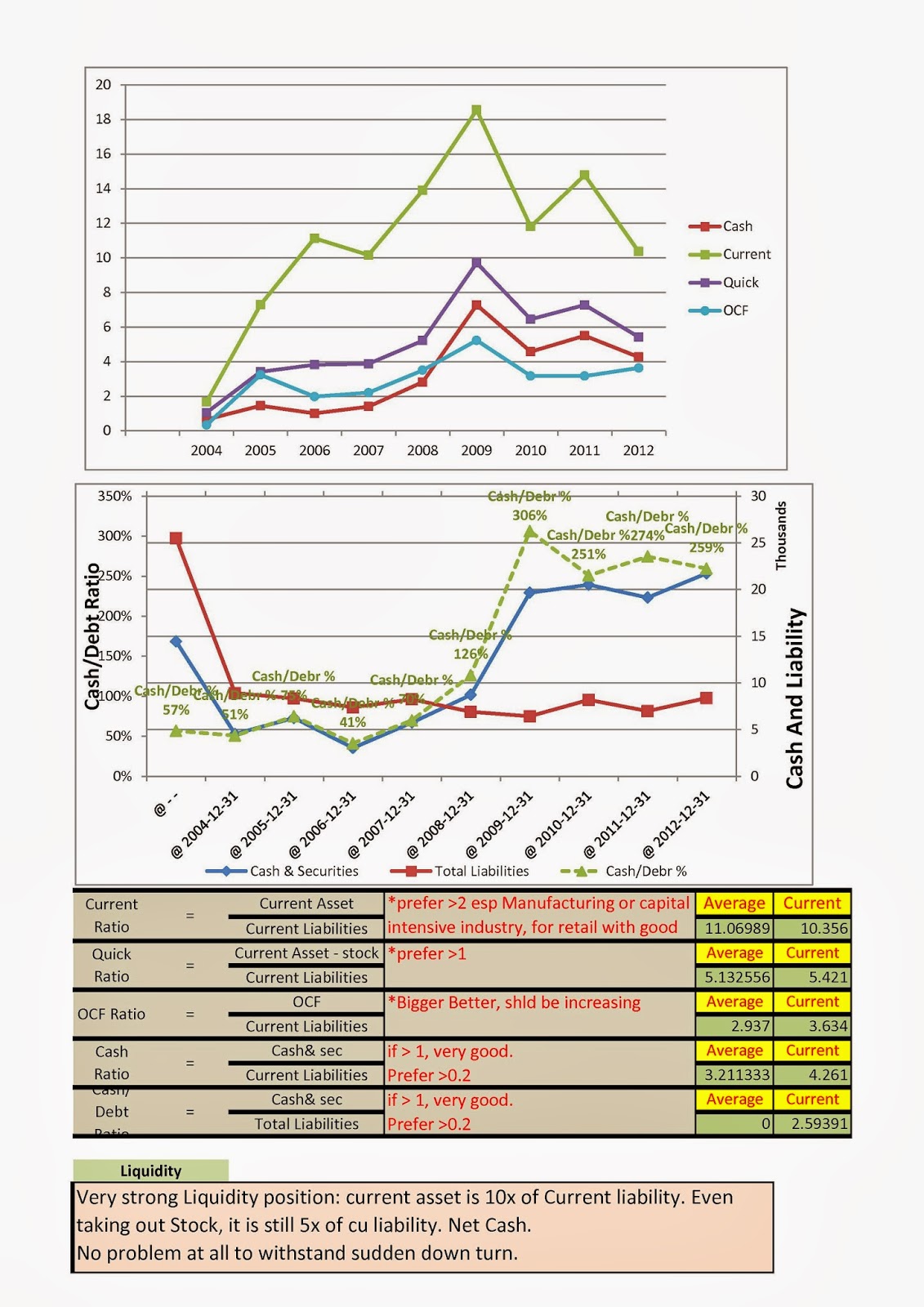

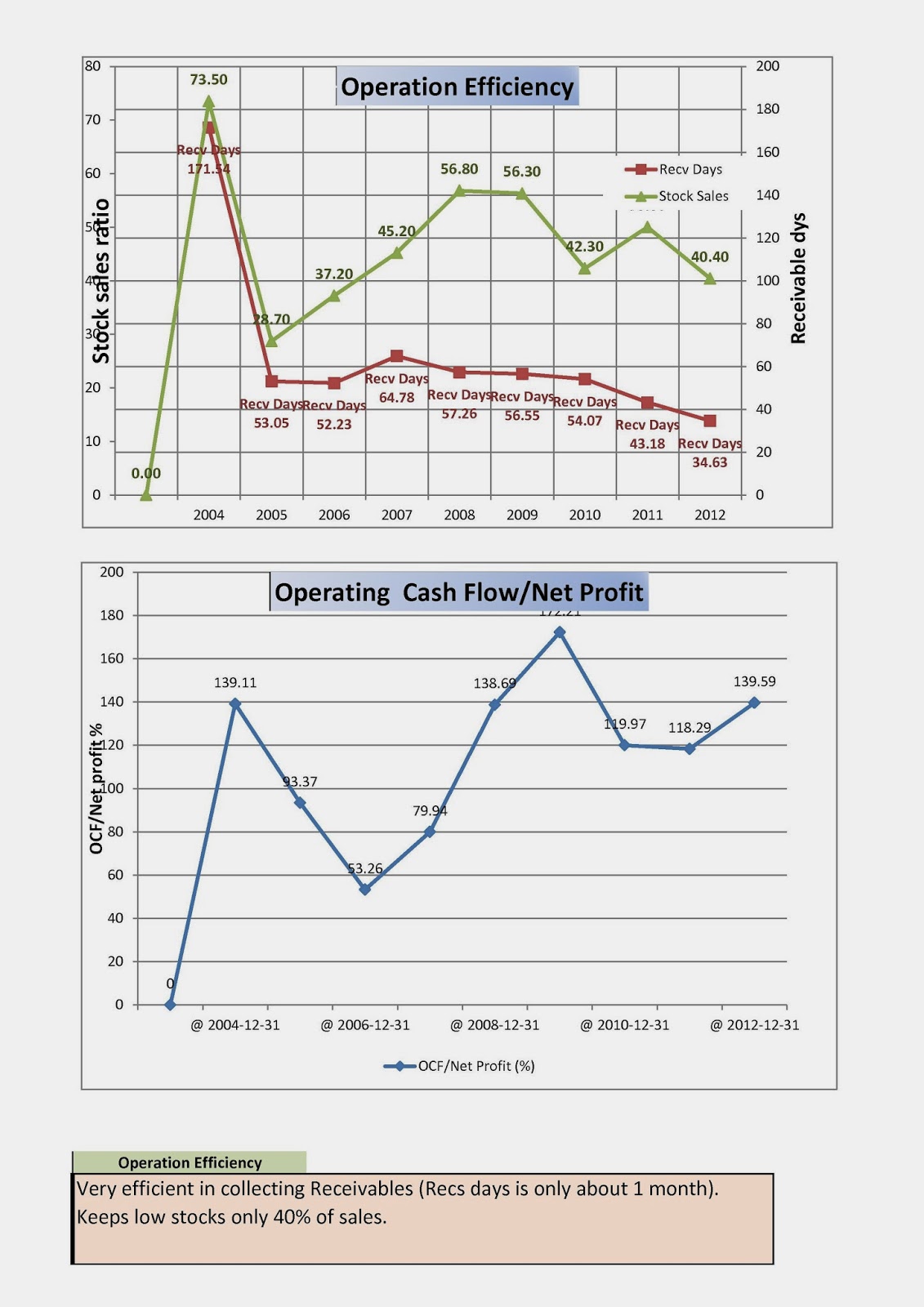

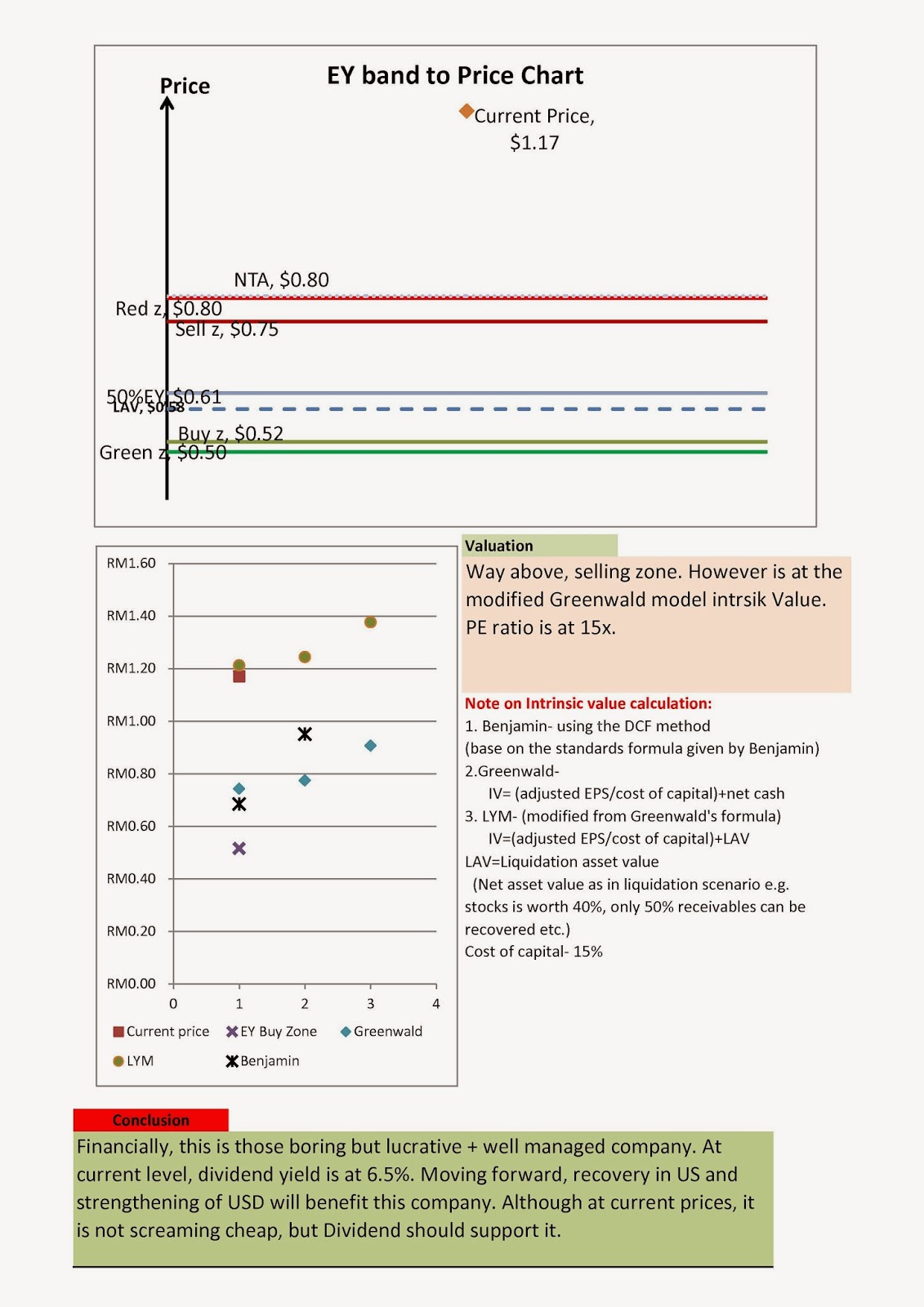

The following charts shows the financial standing of the company with a conclusion in the final chart :

Risk in buying this company:

a. If the economy in US do not recover or makes a down turn. It will certainly hit its topline.

b. The ability to continue to grow the business in double digit growth rate is also not clear and doubtful.

Happy investing!

(For more company articles please click: Company Analysis)

No comments:

Post a Comment